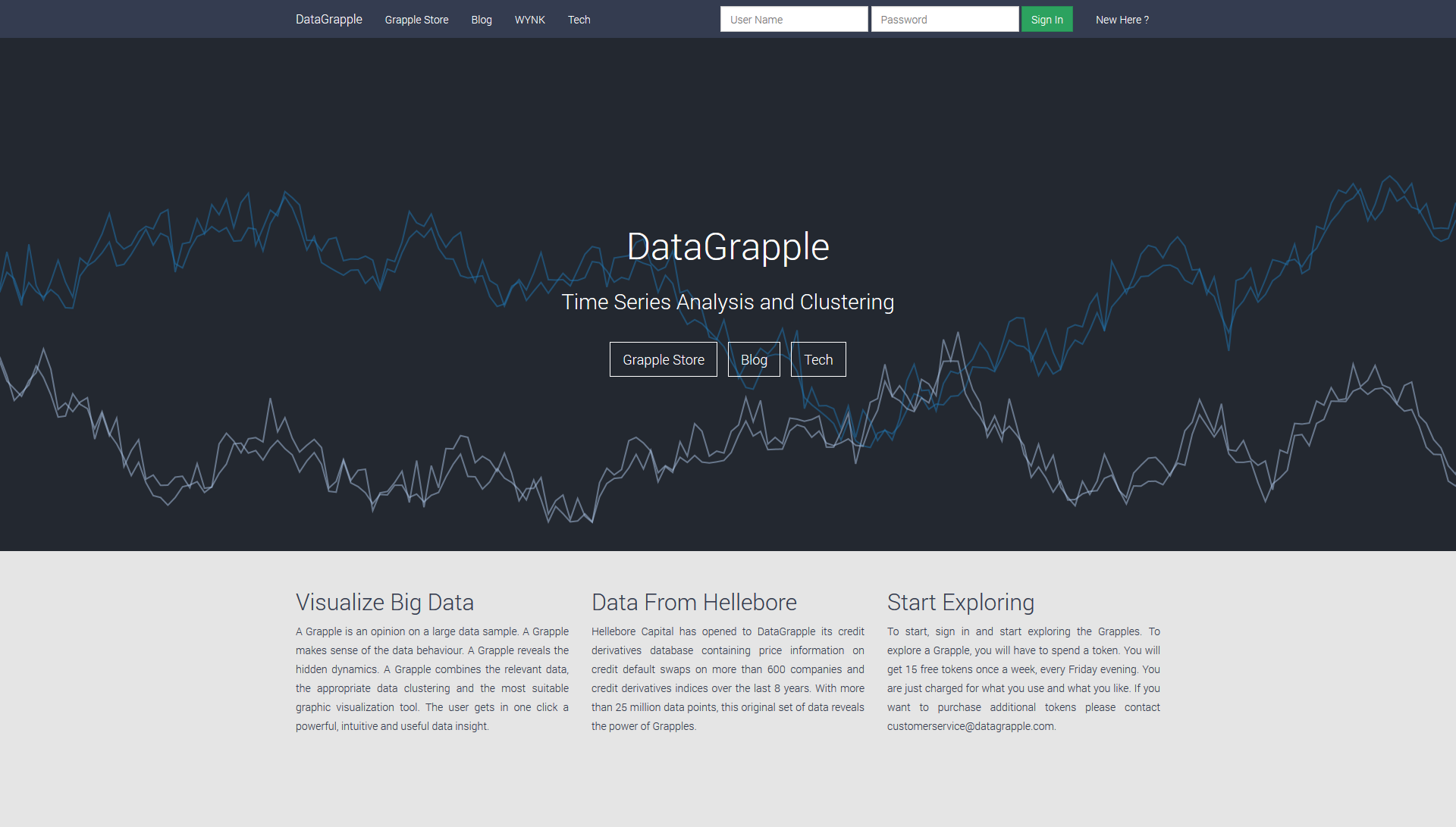

OTCStreaming

OTCStreaming

OTCStreaming ambition is to become the market standard source for Credit Derivatives valuations.

We are receiving data from different sources. On one hand from the Standard Repository Data (SDR) where, as instructed by regulators, every market participant has to upload his trades on cleared instruments (like credit indices) and from multiple not formally formatted messages sent by traders with indication of interests.

The challenge was to be able to extract in real time the data out of this multiple non standardized messages. Then to classify and enrich the data to be able to publish it and calculate closing prices and theoretical valuations.

ScriptMiner

ScriptMiner

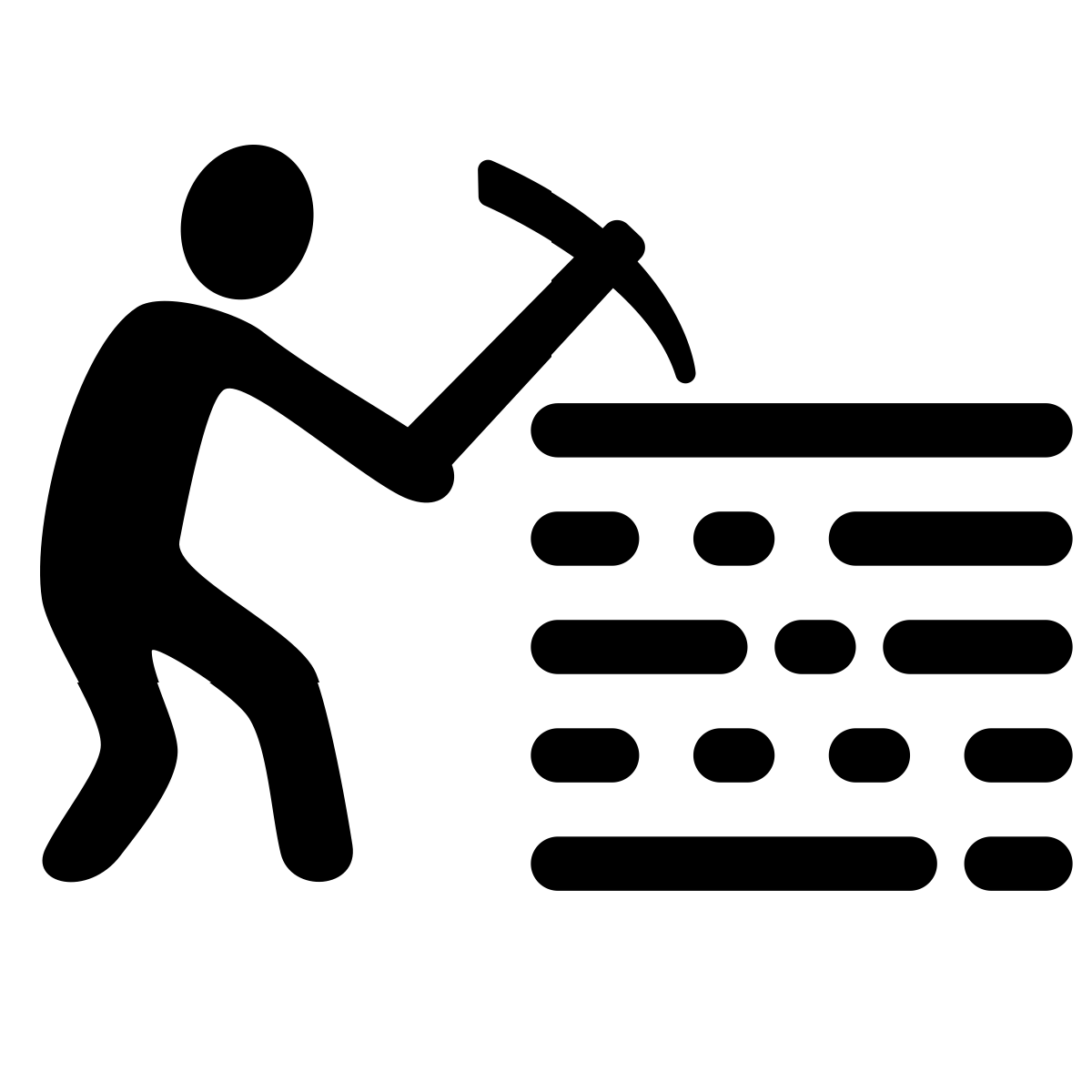

CDSuite

CDSuite Datagrapple

Datagrapple